What Is a Commercial Bank?

A commercial bank is a financial institution that accepts public deposits and makes loans for profit-making consumption and investment. To distinguish it from a retail bank and an investment bank, it can also refer to a bank or a section of a large bank that deals with businesses or a major or middle-sized firm. Commercial banks are divided into two types: banks in the private sector and public sector banks.

The term bank is derived from the Italian word banco, which means “desk/bench” and was used by Florentine bankers during the Italian Renaissance era, who conducted their business on a desk topped by a green tablecloths.However, evidence of banking operations can be found dating back to ancient times.

Due to differences in bank regulation, the term commercial bank was frequently used in the United States to distinguish it from an investment bank. Following the Great Depression, the Glass-Steagall Act dictated that commercial banks were able to were limited to participating in banking activities, while investment banks could only engage in activities related to the capital market. The Gramm-Leach-Bliley Act of 1999 largely removed this split.

How Commercial Banks Work ?

Commercial banks offer basic financial services and goods to people of all ages, including both individuals and small to medium-sized businesses. Checking and savings accounts, loans and mortgages, fundamental investment products such as CDs, and additional services such as safe deposit boxes are examples of these services.

Service charges and fees are how banks make money. Banking fees (monthly management charges, minimum balance fees, overdraft fees, and non-sufficient funds [NSF] charges), safe secret box fees, and late fees vary depending on the product. Apart from to interest costs, many loan packages include fees.

Banks also earn from the interest on loans made to other clients. Deposits from customers are utilised to fund the advances. However, the interest rate paid by banks on money borrowed is lower than the rate levied on money lent. For example, a financial institution may give 0.25% yearly interest on savings accounts while charging 4.75% annual interest on mortgages.

Customers have typically come to commercial banks to employ teller window services and ATMs, or automated teller machines to complete their everyday banking. With the advancement of internet technology, most institutions now allow their consumers to do the majority of the same activities that they might perform in person, such as transfers, deposits, and invoice payments, online.

Function of Commercial Bank

Commercial banks’ activities are classified into two types.

1. Primary functions

- Accepts deposits: The bank accepts savings, current, and fixed deposits. Surplus balances obtained from companies and people are lent to meet the short-term needs of commercial operations.

- Loans and advances: Another important duty of this bank is to make advances and loans to entrepreneurs and company owners while collecting interest. It is the principal source of profit for any bank. In this method, a bank keeps a limited number of depositors as a reserve and gives (lends) the remainder to borrowers in the form of demand loans, overdrafts, cash credit, short-term loans, and other products.

- Credit cash: A customer doesn’t get liquid cash when they receive credit or a loan. The consumer’s savings account is created first, and then monies are transferred to it. This procedure enables the bank to generate money.

2. Secondary functions

- Discounting bills of exchange: A written agreement confirming the quantity of money to be paid against items acquired at a future date. The sum can potentially be settled before the given period by using a commercial bank’s discounting process.

- Overdraft protection: An overdraft protection option allows an individual to debit their current accounts up to a particular limit.

- Buying and selling securities: The bank provides you with the option of purchasing and selling securities.

- Locker facilities: A bank offers lockers for customers to store assets or papers. For this service, banks demand a minimum of an annual fee.

- Paying and collecting credit: It employs various tools such as a note of promise, cheques, and bills of exchange.

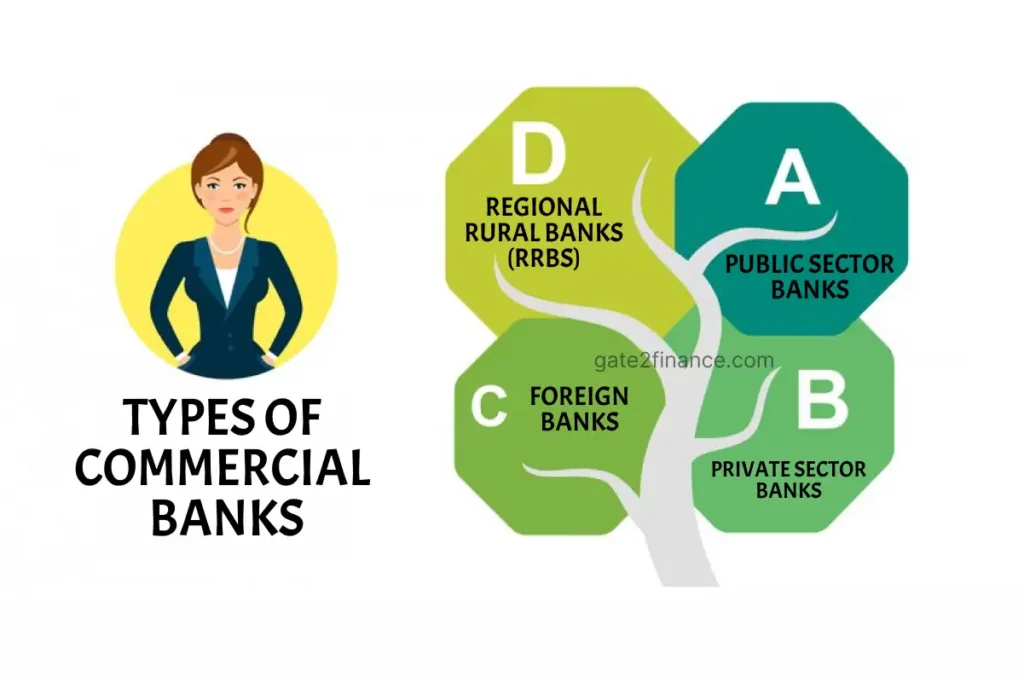

Types of Commercial Banks

Commercial banks are governed by the Banking Regulation Act of 1949, and the business model is meant to make money. Commercial banks can be characterised as public sector banks, private sector banks, foreign banks, or regional rural banks (RRBs).

1. Public Sector Banks:

A country’s government nationalises a certain sort of commercial bank known as a “public sector bank.” These nationalised banks handle more than 75% of all banking transactions in the country. The government owns the vast majority of these public sector banks. The Reserve Bank of India (RBI), India’s central bank, establishes policy for public sector banks. Indian public sector banks include the State Bank of India (SBI), Corporation Bank, Bank of Baroda, Dena Bank, and Punjab National Bank. SBI, the biggest bank in the public sector in India by volume, has merged with five of its partner banks to transform into one of the top 50 banks in the globe (as of April 1, 2017).

2. Private Sector Banks:

A private sector commercial bank is an institution whose goal is to provide privileged services to its clientele. Commercial financial institutions in the private sector are monetary institutions that are predominantly controlled or owned by wealthy individuals and companies. These commercial banks are run by limited liability firms. There are various private sector banks in India. Vysya Bank, the Industrial, Credit, and Investment Corporation of India (ICICI) Bank, and Housing Development Finance Corporation (HDFC) are a few examples.

3. Foreign Banks:

Typically, a foreign bank works as a private corporation in India but has its main office in another nation. Furthermore, these banks must follow the legislation in both their home nations and the countries in which they do business. Hong Kong and Shanghai Banking Corp. (HSBC), Citibank, the American Express Bank, Standard & Lombard Bank, and Grindlay’s Bank are among the foreign banks operating in India.

4. Regional rural banks (RRBs):

These are also scheduled to be commercial banks with the primary goal of giving loans to vulnerable communities such as labourers in agriculture, marginal farmers, and small companies. In India, these institutions primarily operate at the regional level and may have branches in certain urban regions. Odisha Gramya Bank, Arunachal Pradesh Rural Bank, Punjab Gramin Bank, Chaitanya Godavari Gramin Bank, and others are examples of regional rural banks in India.

Why Do Commercial Banks Matter ?

Commercial banks play a significant part in the economy. They not only give a necessary service to consumers, but they also help to create capital and liquidity in the market. Commercial banks provide liquidity by lending monies that their clients spend in their accounts to others. Commercial banks have a role in loan creation, which leads to a rise in output, employment, and spending by consumers, benefiting the economy.

As a result, commercial banks are extensively regulated by the central bank of their respective country or region. Commercial banks, for example, are subject to reserve requirements imposed by central banks. This implies that banks are obligated to hold some of their customer accounts at the nation’s central bank as a buffer in case the general public rushes to withdraw funds.

The process of establishing a commercial bank anticipates the larger role that these institutions will play in the economy. A commercial bank is essentially a pool of investment capital looking for a good return. The bank its structure, staff, procedures, and services is a vehicle for attracting more capital and deploying it in the way that management and the board feel would provide the best return. The financial institution will be more lucrative and its share price will rise as a result of efficient capital allocation.

According to this viewpoint, a bank delivers the previously indicated service to the consumer. However, it also serves investors by functioning as a filter for who receives how much funding. Banks that can do both will be successful. Banks that do not perform one or both of these functions risk failure. In the event of a bank failure, the FDIC steps in to protect depositors and ensure that the bank’s funds are transferred to a stronger bank.

FAQs

How do commercial banks make money?

Commercial banks generate income through interest on loans, service fees, and investments.

Are online banks as secure as traditional banks?

Yes, online banks implement robust security measures to protect your financial information, often exceeding traditional banks.

What factors determine loan approval?

Loan approval depends on factors such as credit history, income, and the purpose of the loan.

Can I trust digital transactions with commercial banks?

Yes, commercial banks employ encryption and secure protocols to ensure the safety of digital transactions.

How do commercial banks contribute to economic growth?

By providing loans to businesses and individuals, commercial banks stimulate economic activity, contributing to growth.